Week #19 Organized Home Challenge

Create Personal Tax Organizer System & Organize Receipts

In this week's challenge you'll take the steps to create a personal tax organizer system, and to organize receipts, to make tax time as simple as possible.

We are currently, as part of the 52 Week Organized Home Challenge, focused on dealing with our paper clutter and getting our financial and other papers more organized, so this week's tasks fit right into that.

In addition, the April 15th deadline for filing just recently passed, but it probably got you thinking how much you'd like to improve your paper organization skills for next year, to make the process of preparing your tax return even easier. The steps in this challenge will help with that, and if you follow them next year's tax filing deadline will not feel so ominous!

Are you new here? The Create A Personal Tax Organizer System And Organize Receipts Challenge is part of the 52 Weeks To An Organized Home Challenge. (Click the link to learn how to join us for free for future and past challenges if you aren't already a regular reader).

This week's tasks will not be too hard for most people, since if your taxes are easy to do, your organization system for receipts and tax documents can be simple too.

On the other hand, the more complicated your tax situations is, the more onerous your organizing requirements may become.

This challenge is geared towards creating a personal tax organizer system that leans towards simplicity, since that is realistically all that many of us need.

However, if you do a lot of itemization of deductions, or have a small business or partnership for example, always consult a tax professional to find out what types of items to file and keep for reference for your taxes.

Step 1: Understand The Broad Categories Of Receipts So You Can Organize Them Easily

The first step in the Create a Personal Tax Organizer System and Receipt Organization Callenge is to conceptually understand the various categories of receipts, so you can deal with them accordingly.

Here are the broad categories of receipts that you should consider, and categorize each separate receipt into when dealing with your paperwork on a weekly basis.

- Receipts for minor purchases, most of which you'll need to reference in a couple of months, at the max, or never again

- Receipts for major purchases, which you should keep as part of your personal home inventory to help you with insurance claims, warranties, etc. if needed in the future

- Receipts for real property or cars (including improvements and repairs), such as your home or other large assets, which eventually may be needed for tax purposes to show gain or loss, or depreciation, for example, but not in the current year

- Receipts that will back up deductions or other entries on your tax return for this current year

Step 2: Make A Habit Of Dealing With Your Receipts And Any Tax Documents Weekly

The key to success with this week's organizational challenge is to get in the habit of dealing with and filing your tax documents and receipts on a regular basis, so they don't pile up, and you forget what a certain receipt or piece of paper signifies, or lose it in a pile of stuff.

In last week's challenge, about organizing bills, I asked you to set aside a set period of time on a weekly basis to pay bills, and deal with other financial matters. One of those financial matters you should deal with during this weekly paperwork meeting with yourself is any receipts and tax documents that you have received or accumulated over the week.

If you haven't set up this weekly schedule yet, check out this article about your weekly paperwork session which discusses in more detail what this entails.

In the steps below I'll share with you the types of tasks you should do, during this paperwork session, related to receipt organization (which will take you about 5-10 minutes maximum, if you have just a normal amount of receipts to deal with).

During this time you'll look at each receipt or other tax document, figure out which of the four categories it belongs in, and then file it accordingly.

What If You've Accumulated A Lot Of Old Receipts?

The process I've described here in this article will help you organize your receipts and tax paperwork from now on, as it comes into your home. That's the best way to stay on top of everything. But what about if you have a lot of old receipts piled up from before?

If that describes your situation you have an extra task this week. In addition to setting up better organizational systems for the future, you'll also need to declutter a lot of those accumulated old receipts, the vast majority of which will go straight into the recycling bin or shredding pile.

To help you with this task I've written an article about how to declutter and then organize old receipts, so check it out for further details and encouragement.

Step 3: Create Your Filing System For Minor Receipts & Way To Collect All Receipts

The third step in this Challenge is to create a system to collect all receipts as you receive them, and then to also have a built in filing system for the minor purchases types of receipts, which are the most common types of receipts.

Examples of minor receipts are receipts for groceries, gas used for personal (non-business) cars, small clothing purchases, entertainment expenses, etc. These are the types of receipts that you need to keep only for a short time period, and then they can be discarded.

I suggest everyone collect all their receipts in a receipt envelope or receipt organizer that you can carry around in your purse or wallet.

Then, once a week, as part of the weekly paperwork session, you go through the receipts collected in your envelope and separate them into the categories mentioned above, filing those necessary to keep longer term, and then the majority of them filing in a simpler manner in the same place you file old bill stubs, since you'll discard the majority of them more quickly.

I've explained in this article how to create a receipt organizer, and how this organizational system works, along with your weekly paperwork session, to help you organize all of your receipts.

Step 4: Create A System For Filing Major Receipts Necessary To Complete Your Personal Home Inventory

This step is actually covered more in a separate week of this challenge, so I'll just reference it here now.

In another week of the 52 Week Organized Home Challenge I discussed creating a personal home inventory, giving steps for how to do it.

Basically, the idea is that you want to have proof of your large purchases, such as large appliances and electronics, etc. if a disaster occurs and you need to file a claim with your home or renters insurance company. Pictures and inventories of what you own help the insurance company, as well as seeing receipts of how much the items cost, when new (or new to you).

Read the instructions from that challenge for more ideas on how to organize receipts such as these. Further, we'll touch again on many of these documents when we organize and store our home warranties in a later challenge.

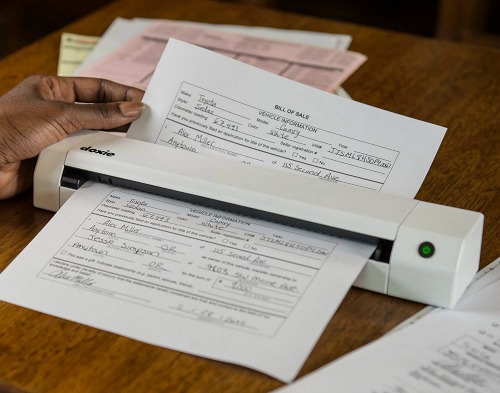

Should You Consider A Receipt Scanner?

You may want to consider scanning your receipts and documents and storing them electronically, at least for categories 2-4 of the receipts. This can be especially helpful for cheap items, printed from a receipt roll on a cash register, which seems to have the ink fade after a couple of months.

Doxie Go portable scanner

Doxie Go portable scanner[Click here to purchase on Amazon]

If you are going to store receipts electronically make sure you only save the ones worth saving though, so you don't waste your valuable time scanning recipts you'll never reference again. That's why I don't recommend scanning receipts that fall into the first category of minor receipts, for example.

Further, you need to have an adequate back up system for all electronic files if you decide to scan receipts to make sure you don't lose anything if your computer's hard drive crashes, for example.

Many people have scanners these days, and these will work for digitizing a few receipts here and there. However, recently companies have also created portable scanners which easily scan documents of many sizes and can be used many places.

I have to admit these receipt scanners look pretty cool, but they may be a bit of overkill for the average home. However, if you've got lots of receipts for work or a home business it may be worth considering one.

Step 5: Home Filing System For Tax Documents That May Be Used In Later Years, But Not Now

In step 5 of the Challenge, you're going to organize one of two major categories of tax documents. This category of tax documents are those types of documents you won't reference in this coming year's taxes, but may reference in tax returns several years from now. It includes things like home care and improvement expenses, insurance documents, retirement investments and non-retirement investments, etc.

In reality, with the way I've organized the 52 Week Organized Home Challenge, you're actually going to making files for all these types of documents next week, when we organize the files in your home. I'm just mentioning this step here mainly so if you don't do that challenge you'll know you need these types of files for organizing all your tax documents.

Step 6: Create A Personal Tax Organizer System For Storing Your Tax Documents You'll Reference In This Year's Tax Returns

In step 6 of the challenge is to organize your tax documents and receipts that you'll reference this year, when you do your taxes.

The IRS gives very little guidance about how to organize your paperwork, merely saying:

You should keep your records in an orderly fashion and in a safe place. Keep them by year and type of income or expense. One method is to keep all records related to a particular item in a designated envelope.

IRS Publication 552: Recordkeeping For Individuals

As you pay bills, or otherwise get documents throughout the year that you will need to reference again when preparing your year's tax returns it is important to put everything into a personal tax organizer system so everything is organized and ready to reference when you sit down to do your taxes (or give to your tax preparer).

I will caution that the more complicated your taxes, and the more documentation needed to support them, the more elaborate your personal tax organizer system needs to be. On the other hand, if doing your taxes is a fairly simple matter, go with a simplistic system to fit your needs. No need to complicate something that doesn't need to be!

You will create a new tax organizer file each calendar year, fill it up all year long as you receive various documents and receipts, and then once your taxes are completed for that year you'll even keep a copy of the tax return forms for the year right in the organizer. It keeps all the officially filed forms and all back up documentation together, in case you ever need it.

To get step by step instructions for how to make this tax organizer, and also for a list of suggested categories for this organizer file, check out my article on how to create a tax organizer for the current year's tax documents.

Step 7: Create A System To Purge Documents Periodically Without Causing Yourself Liability Worries

A frequent question is how long to keep tax records, and the personal tax organizer system you'll create for every year? The short answer is "it depends."

Frankly, the IRS doesn't make it very easy for you to have a simple answer to this question, since there are always exceptions to the rule.

I tend to be conservative because I don't want to get rid of paperwork if it may come back to haunt me, if for example, you have an audit or other encounter with the IRS. In my opinion, this trumps a little filing space since with my personal tax organizer system above all your tax documents will be held in one expandable folder or small filing system anyway, and it doesn't take up too much room.

Many tax professionals suggest to hold onto your filed old returns forever (you can digitize them if you don't want to keep track of the paper anymore), and to keep all supporting documents for at least six or seven full tax years after you filed, since six years is the longer limitations period for the IRS, typically.

There is even an exception to that rule though. If you never filed a return, or filed a fraudulent return, you should hold onto all documentation indefinitely, since there is no limitation period in those situations.

I've written an article you can consult for more information about how long to keep various types of papers here. It discusses how long to keep various tax documents, as well as various types of receipts, and many more categories of paperwork.

In addition, here's my article on how to organize old tax records in your home filing system for those papers that you still are under a legal obligation to keep.

Listen To Taylor's Video Tips For This Week's Organized Home Challenge & Declutter 365 Missions

Do you want more in-depth tips and instructions for how to do this week's missions and challenge all about decluttering and organizing receipts and tax documents? If so, I've got recorded video tips from me, Taylor, from the video archives in the Declutter 365 Premium group, all about this week's challenge and missions.

These video tips are available on demand in the archives, once you're a member of the group.

In Week #19's video I discussed the following topics, among others:

- How long should you keep various papers when organizing and decluttering

- Key habits for keeping receipts organized

- Tips for organizing tax returns and tax documents

- Declutter 365 missions for week

I suggest watching the video archive for the week, perhaps while you're doing some decluttering or cleaning around your home, before starting the week's missions and Challenge, and then you'll be able to breeze through this week's worth of decluttering missions, as well as organize what's necessary for the 52 Week Organized Home Challenge, based on the advice and instructions within those videos.

It really is like having me, Taylor, available, 24-7, as your decluttering and organizing coach, for every area of your home!

Plus, once you're a member of Declutter 365 Premium you get access to not only this video, but all the videos for the 52 weeks of the year, for 6 years (that's over 270 videos available in the archives!)

Get This Bills & Financial Decluttering Checklist + 32 Other Decluttering Checklists For Your Home

Right now you're decluttering papers and other items dealing with your bills and financials, and there's a lot of these types of items around your home.

I've done the hard work of breaking down these tasks into smaller more manageable steps for you, so you don't get overwhelmed or worry you're forgetting a task, and you can go at the pace you want, whether that's fast or slow.

In addition, you can tackle these decluttering tasks in whatever order you want when you use these checklists!

Tell Me How The Create A Personal Tax Organizer System Challenge Is Going For You

I would love to know how this week's Create a Personal Tax Organizer System and Organize Receipts Challenge is going. You can tell me your progress or give me more ideas for how you've organized your tax documents and receipts in the comments.

I also love before and after pictures of your receipt organization and tax filing system and would love to see some of yours. Submit your pictures (up to four per submission) and get featured in the Creative Storage Solutions Hall of Fame. You've worked hard to get organized, so now here's your chance to show off!

Further, I've created a list of decluttering missions to do to get rid of financial and bill clutter, so check it out and if you do a mission tell me about it.

Sneak Peek For Next Week's Challenge

We're working on our homes slowly, one area at a time, so don't get too distracted from the Create a Personal Tax Organizer System And Organize Receipts Challenge this week. However, I want you to know that this I don't expect you to deal with all of your papers this week, but instead we are still in the midst of dealing with our paper clutter.

Next week we'll finish putting a lot of the pieces of the paper organization puzzle together when we work on organizing files in our home filing system.

Make Sure You Make The Most Of These 52 Organizing Challenges

Get your copy of the printable one page 52 Week Organized Home Challenge schedule for the year here, so you can see all the challenges we're working on.

Further, if you'd like to join a community of others who are all commmitted to these organizing challenges and corresponding decluttering missions, and want more interaction with me, Taylor, video archives of Taylor providing more tips for each of these challenges and missions, as well as live monthly group coaching sessions focusing on the skills and habits necessary to maintain your home from now on, I'd urge you to join the private and exclusive Declutter 365 Premium Facebook group (you can learn more about it at the link).

In addition, have you gotten your Declutter 365 Products yet, to make sure you can get even more assistance with decluttering and organizing your home this year? There are both free products (like the Declutter 365 calendar, a $20 value), as well as add-ons, such as daily text messages, planner stickers, and a Premium Facebook group, as well as a pack of printabe decluttering checklists.

Nothing in this challenge should be construed as tax or legal advice, and you are advised to always consult an account or legal adviser for exact details and guidance for your unique tax circumstances.

Some links on this page are affiliate links, meaning that if you purchase a product through them I receive a small commission which helps me provide this information to you for free, plus support my family. My integrity and your satisfaction are very important to me so I only recommend products I would purchase myself, and that I believe would benefit you. To learn more please see my disclosure statement.

Share Your Comments, Tips & Ideas

I would love to hear from you, sharing your thoughts, questions, or ideas about this topic, so leave me a comment below. I try to always respond back!