How To Create A Tax Organizer For This Year's Tax Documents

Today's Declutter 365 mission is to create a tax organizer for the current year's tax documents, so all your paperwork is organized and ready when it's time to do your taxes.

This mission is designed to be done while working on the Organize Receipts & Tax Documents Challenge, which is part of the 52 Week Organized Home Challenges here on the site.

The idea of this task is that I want to stop the cycle of dread you may feel when it's tax time, and before you can even begin to do your taxes (or get your accountant or other tax professional to help you do the taxes) you've got to gather up all the supporting documentation that has accumulated over the past year.

If you have a big mound of bills, junk mail, receipts from your purse and other places, documents you've received in the mail, cancelled checks and more, and to find the few things you need you have to sort through it all, it will be a big overwhelming task.

However, if you place all the tax documents you receive throughout the year in one place, inside your designated tax organizer folder, as they're received, you can stop the frantic or laborious process of gathering tax documents from now on, and just grab your organizer and be ready with all the relevant paperwork ready to reference when it's time to get the taxes done.

How To Make A Simple Tax Organizer

Expandable File Folder To Hold Tax Documents

Expandable File Folder To Hold Tax Documents[Click here to purchase on Amazon]

All you need to make your own tax organizer is an expandable folder such as the one shown to the left. Label the outside of the file folder with the year of the documents it will contain. (You'll make a new tax organizer each year).

Next, think of the categories of documents you need to save for tax time, such as documents showing the income you've received, the expenses you've had, and the deductions you want to take (I've listed suggested categories below) and label the sections of the expandable folder with these categories, so as you receive these types of documents you can sort them as you go within the organizer.

Example categories you may wish to include in your personal tax organizer system include the following (add or subtract to this list as needed, based on your unique circumstances):

- Income (including documents received from third parties, such as form W2s and form 1099s)

- Medical

- Donations

- Child care costs

- Business or professional deductions

- Tax correspondence (with IRS or state officials)

- Student loan payments

- Misc. receipts for other deductions

- Payments of tax made throughout year (such as for quarterly estimated taxes, etc.)

- Slot for your copy of your filed tax return, once it is completed

Notice I said as a category to leave space to save a copy of your filed tax returns in this organizer, for that year. If you do this this tax organizer is also a simple way to keep all your returns and their back up documentation together, in one place, for easy access and reference later if needed. (You can check out the article about how long to keep old tax records, and how to organize old tax returns here for more details.)

Expandable Folders {Referral Links}

Ready Made Tax Document Organizers

If you don't want to make your own tax organizer you can also get ready-made organizers designed to do the job. Here are a few that are available:

Premade Tax Organizers {Referral Links}

Each Week File Any Tax Documents You've Received Into Your Tax Organizer During The Weekly Paperwork Session

Once you've created your tax organizer folder, now it's time to fill it up, and you do that each week of the tax year as part of the weekly paperwork session.

It's pretty simple, actually. As you receive documents that you need to save for tax purposes during the course of the week, you put them aside in your designated place that once a week you sort through. You'll pay bills, deal with banking needs, shred unneeded documents, and file what needs to be filed. Part of the filing may go into your home filing system, but the tax documents for the year will get filed into that year's tax organizer. That's it. Simple, huh?

You can read more about the weekly paperwork session, and why I highly recommend you do it to keep your paperwork under control and organized from now on in the link below:

Quick Note About Digital Documents

I understand in this day and age we sometimes have documents we receive digitally, instead of on paper, and that can include documents you need to use as back up documentation for filing your tax returns, like business receipts, for example.

To the extent you've got these types of digital documents you need to make yourself the equivalent of a tax organizer folder within your digitally organized computer files, where you keep these types of files.

I suggest you identify what types of tax documents you receive digitally, and then make a specific digital folder for them (a new folder each year, so they stay organized by tax year) within your documents folder section of your computer. Then, you can still be digitally filing these files regularly for reference when needed.

You can read more information about how to organize computer files here for more tips and ideas.

Photos Sent In By Readers Of How They Organize Tax Documents

There are often multiple ways to organize items within your home, and organizing tax documents is no exception.

Here are photos sent in by readers who've done this mission and set up systems to organize current tax documents, so as papers are received throughout the year there's a place to store them and keep everything together and organized until it's time to do the taxes.

I'm showing you these photos to help you visualize a system that will work for you, and also to show you how simple creating such a system can really be.

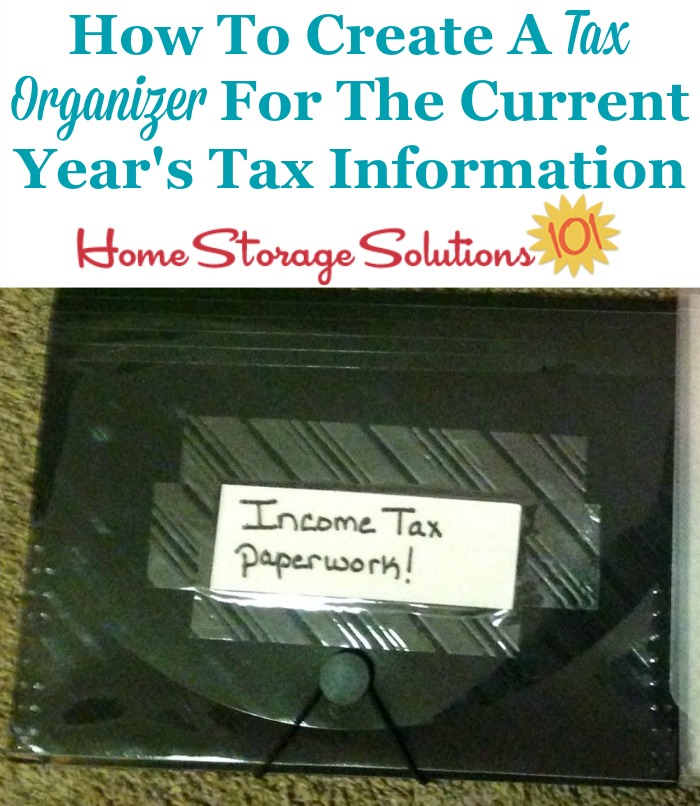

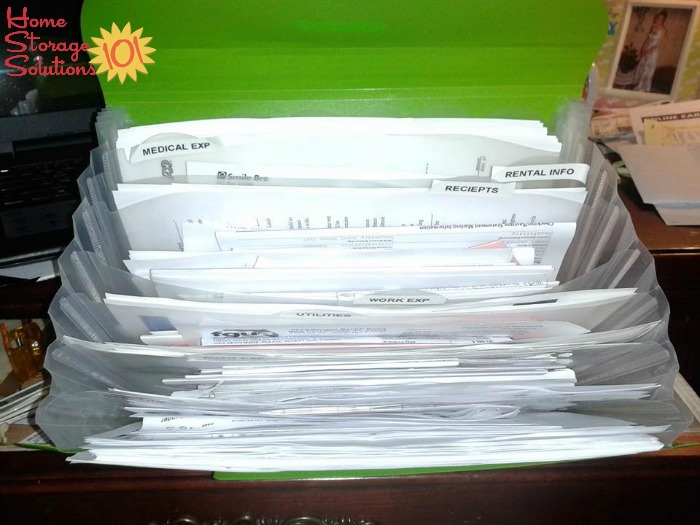

First, here's a photo from a reader, Marlo, who created a tax organizer similar to the one I've suggested you make in the instructions above. Marlo stated,"I use the file folder to hold all of our papers and receipts throughout the year so in January just add W2's etc. I bought the folder in the dollar section at Target!"

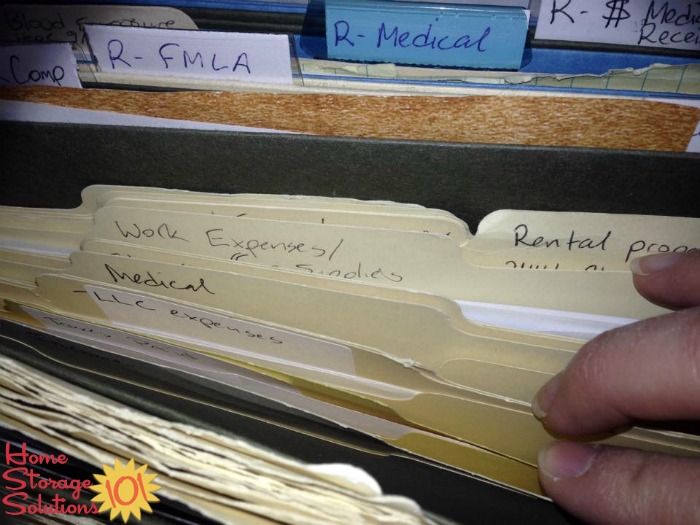

You don't have to use an accordian folder like I've suggested though. You can set up files within your filing system in a similar way, if you'd like to keep your tax information for the year there instead. Here's an example of that sent in by a reader, Jen. She said, "I have to separate our tax receipts by category too, so the one folder for "taxes" wasn't enough. I wonder if we are really that complicated or if our CPA is that uptight?" She continued, "They don't take up a ton of space. Here they are, right behind my tickler files.

Finally, here's a photo from Kathy, who had gotten so stressed about the big stacks of paper she'd accumulated, and not knowing what was in there, that she took the time to sort through and get everything organized.

She said, "here is a pic of one of the things I did today -- FILING. Yes, I threw stuff in the drawer too long (1 year) and so today I did the job of going through and getting ready for taxes as well as tossing out the junk. The other things I did was set up the file, and also one for this year to stop that habit of tossing them away to be seen 12 months later."

When you set up your tax organizer you'll feel such a sense of relief, just like Kathy, since you'll be taking control of your paper piles from now on!

Want To Do More Decluttering Missions? Get Started With Declutter 365 Today!

Once you declutter one type of item in your home I bet you'll want to declutter some more. After all, decluttering gives you a great reward for even a small investment of time and energy.

The Declutter 365 system is designed to help you declutter, over the course of a year, your entire house, with just 15 minutes of decluttering each day!

Hundreds of thousands of people use this proven system to get rid of their clutter, and bring peace and calm back to their homes.

Declutter 365 works to guide you to clear the clutter without overwhelm, focusing on just one small area at a time, and without making a huge mess in the process, so you see consistent forward progress without all that "messy middle" that makes it even harder to function in your home than before you started.

In addition to building a daily decluttering habit, the Declutter 365 program, along with the accompanying 52 Week Organized Home Challenge, teaches you the skills, habits, routines, and mindsets necessary to maintain the clutter free and organized state of your home from now on, so it'll never be as messy and cluttered as it is right now, ever again.

If you haven't already, make sure to get your copy of this year's Declutter 365 annual calendar here (it's FREE!), find today's date, and do 15 minutes of decluttering on the day's mission. Then, repeat again tomorrow, and again and again. Over the course of the next year, if you do this 15 minutes per day, you'll declutter your whole house!

Get This Bills & Financial Decluttering Checklist + 32 Other Decluttering Checklists For Your Home

Right now you're decluttering papers and other items dealing with your bills and financials, and there's a lot of these types of items around your home.

I've done the hard work of breaking down these tasks into smaller more manageable steps for you, so you don't get overwhelmed or worry you're forgetting a task, and you can go at the pace you want, whether that's fast or slow.

In addition, you can tackle these decluttering tasks in whatever order you want when you use these checklists!

Some links on this page are affiliate links, meaning that if you purchase a product through them I receive a small commission which helps me provide this information to you for free, plus support my family. My integrity and your satisfaction are very important to me so I only recommend products I would purchase myself, and that I believe would benefit you. To learn more please see my disclosure statement.

Share Your Comments, Tips & Ideas

I would love to hear from you, sharing your thoughts, questions, or ideas about this topic, so leave me a comment below. I try to always respond back!